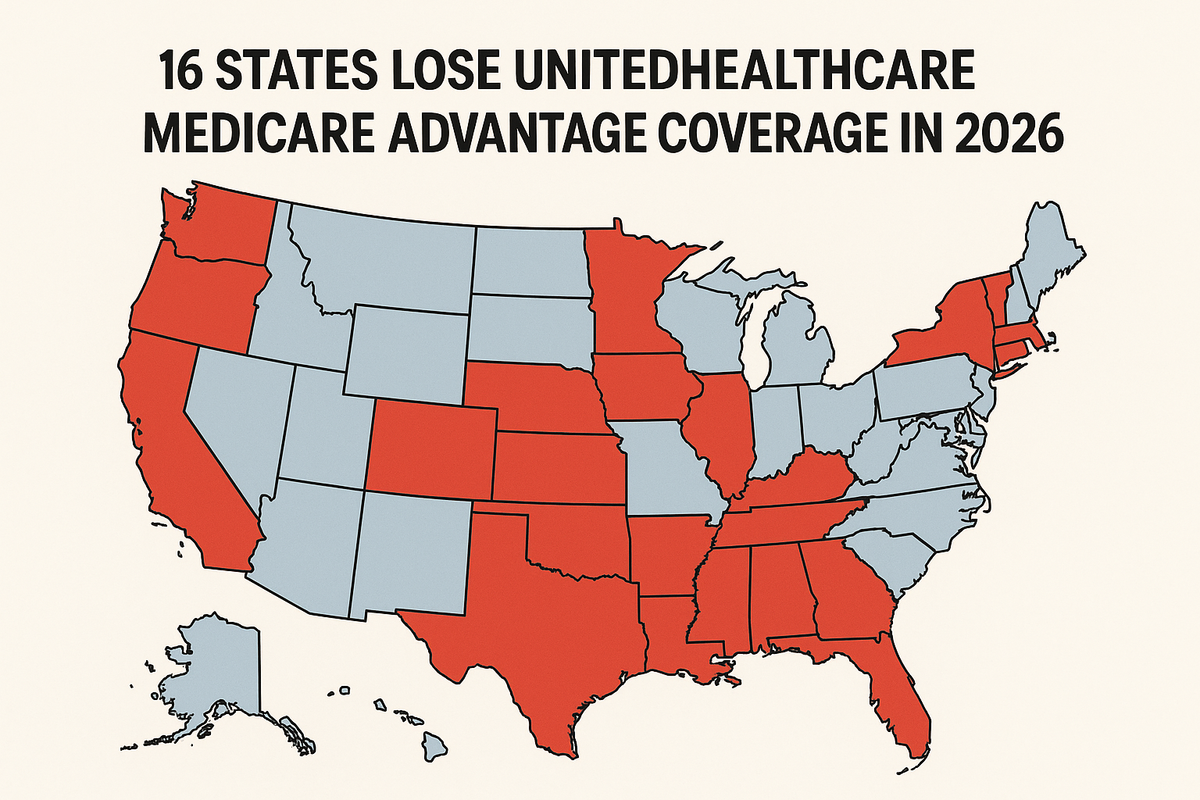

16 States Lose UnitedHealthcare Medicare Advantage Coverage in 2026

Major insurers are strategically reducing Medicare Advantage plan availability, with UnitedHealthcare cutting coverage in 16 states to improve financial performance.

UnitedHealthcare's decision to eliminate Medicare Advantage plans in 16 states signals a broader industry shift that directly impacts Long Island employers' benefits strategy and bottom line. When major carriers reduce coverage options, it creates a ripple effect that drives up costs for employer-sponsored plans and limits your ability to offer competitive retirement benefits.

The carrier pullback isn't limited to UnitedHealthcare. Aetna is reducing prescription drug plans in 100 counties, while Anthem is cutting standalone prescription drug coverage entirely. This coordinated reduction in coverage options means fewer choices for your employees approaching Medicare eligibility, potentially forcing them to delay retirement or seek more expensive alternatives that could impact your group plan costs.

Why Nassau and Suffolk County Employers Should Care

Medicare Advantage plan reductions create immediate financial pressure on Long Island businesses in three ways. First, employees who planned to transition to Medicare Advantage may now stay on your group plan longer, increasing your total enrollment costs. Second, reduced competition among Medicare plans typically drives up supplemental insurance premiums that affect your retiree benefits budget. Third, employees facing limited Medicare options may demand enhanced pre-retirement benefits to bridge the gap.

The timing couldn't be worse for employers already managing projected rate increases for 2026. Early rate filings indicate significant premium hikes across multiple carriers, and reduced Medicare Advantage availability eliminates one of the traditional cost-relief strategies for businesses with aging workforces.

Long Island's demographics make this particularly challenging. Nassau and Suffolk Counties have higher-than-average concentrations of employees in their 50s and early 60s who were counting on specific Medicare Advantage options. When these plans disappear, it forces difficult conversations about extended COBRA coverage, retiree health benefits, or early retirement packages that strain your budget.

The Real Cost of Carrier Consolidation

Every eliminated Medicare Advantage plan represents lost leverage in your benefits negotiations. Fewer carrier options mean less competition, which historically translates to higher premiums and reduced benefits flexibility. For Long Island employers, this could mean 8-12% higher group plan costs as carriers face less pressure to compete on price.

The prescription drug plan reductions hit particularly hard. When Aetna eliminates coverage in 100 counties and Anthem cuts standalone drug plans, it forces more prescription costs back onto employer plans. Employees who would have transitioned to Medicare Part D coverage may now require enhanced pharmacy benefits through your group plan, increasing your annual benefits spend by $2,000-$4,000 per affected employee.

Professional service firms in Nassau and Suffolk Counties face additional challenges because their employees often have higher prescription drug needs and expect comprehensive coverage. When Medicare options shrink, these employees either delay retirement (increasing your long-term benefits costs) or demand enhanced pre-retirement benefits that can add 15-20% to your annual benefits budget.

Strategic Response for Long Island Employers

Smart employers are already adjusting their benefits strategy to address carrier consolidation. The key is identifying which employees planned to transition to Medicare Advantage and developing alternative cost-management strategies. This might include restructuring your group plan to encourage earlier retirement with enhanced COBRA subsidies, or negotiating direct-pay retiree coverage that reduces your long-term liability.

Consider implementing a formal retirement benefits audit now, before these changes fully impact your costs. Employees facing reduced Medicare options need clear information about their alternatives, and you need accurate projections of how many might stay on your group plan longer than anticipated.

The most successful Long Island employers are also exploring alternative funding strategies for prescription drug coverage. When Medicare Part D options shrink, employer-sponsored pharmacy benefits become more critical. This might mean negotiating enhanced pharmacy networks or implementing prescription drug management programs that control costs while maintaining coverage quality.

Immediate Action Items

Review your current employee demographics to identify how many workers are within five years of Medicare eligibility. These employees need immediate communication about changing Medicare options and how it affects their retirement planning. Delayed action here leads to last-minute benefit changes that cost significantly more than planned transitions.

Audit your current retiree benefits policies to understand your exposure if employees stay on group coverage longer. Many Long Island employers haven't updated these policies in years and may be legally obligated to provide coverage that's now more expensive than anticipated.

Ensure your benefits documentation and compliance reporting accurately reflects any changes to retirement benefits or COBRA administration. Carrier consolidation often triggers plan document updates that must be completed before your next plan year.

Benton Oakfield's Carrier Consolidation Response

Benton Oakfield's annual plan review process specifically identifies cost impacts from carrier consolidation before they hit your bottom line. Our Long Island clients receive detailed analysis of how Medicare Advantage reductions affect their specific workforce demographics, plus alternative strategies that maintain benefits quality while controlling costs.

We're already working with Nassau and Suffolk County employers to restructure benefits packages that account for reduced Medicare options. This includes negotiating enhanced pharmacy benefits, implementing retirement transition programs, and developing cost-sharing strategies that protect both employer budgets and employee coverage needs.

Compliance Note: Benefit plan rules and tax implications vary based on company size and location. This summary is for informational purposes only. Please contact your Benton Oakfield representative to review how these changes impact your specific plan documents.